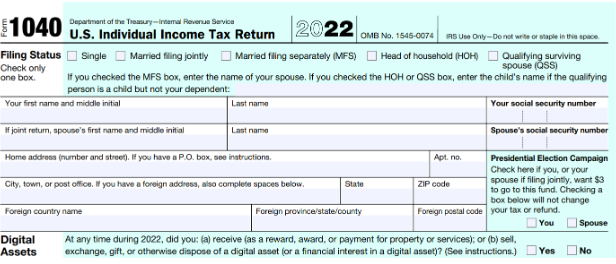

- IRS has included a checkbox in its Form 1040 asking whether the individual was involved in any digital asset transaction.

- Taxpayers should maintain their Bitcoins and include them, as per regulations, in their financial reports.

The United States observes April 15 as Tax Day, a national holiday, on which thousands of individuals are due to submit their Individual income tax returns to the federal government. The day is shifted a few days if it falls on a weekend or public holiday, but this has been the practice since 1955.

Cryptocurrencies like Bitcoins and Ethereum are all about privacy where the network does not ask for your details and many crypto traders remain anonymous. However, they are not covered in a cloak of invisibility. The IRS, in 2017, asked Coinbase to submit data on all the transactions done by their customers from 2013 to 2015, amounting to nearly $20,000 worth of BTC transactions by more than 14,000 customers. Following this, they sent letters to more than 10,000 people regarding suspected tax flaws.

This shows how stern the IRS can be regarding cryptocurrency taxes which is also reflected in its continuous amendments in Form 1040 and steady efforts to educate and aware crypto traders of them. Moreover, it’s a responsibility to keep a record of your Bitcoin trading, and in case you casually or intentionally fail to report your losses or gains, you are liable to fines in addition to taxes. Chances may be that IRS will keep you on full-audit further exposing you.

It’s Uncle Sam Knocking

The IRS on its official website defines digital assets as, “any digital representation of value which is recorded on a cryptographically secured distributed ledger or any similar technology as specified by the Secretary.”

Further, it treats these digital assets as property, and all the tax principles applicable to property are applied to them. They have asked to report all the digital assets activity on tax returns.

The digital assets classes include convertible virtual currency, cryptocurrency, stablecoins, and NFTs but are not limited to just these.

The Form 1040 issued by IRS is used to calculate the total taxable income of US residents and determines the total amount to be paid and refunded by the government. Since 2020, it started including a question asking if the individual participated in any digital assets transactions. The schedule D of the form reports all the capital gains.

Should You Open The Door

Cryptocurrencies are volatile and transaction data helps in reducing your tax burden. If you got some coins at $10, after five years of holding, they are worth $50 each. You earned capital gain and without any document to prove that you purchased coins when they were just $10, you might be taxed with their current value. Based on the various types of Bitcoin dealings the taxation rules may differ.

If you are simply buying crypto and holding it for a period of time, then it is not taxable. Only events regarding selling, spending, trading, or swapping are taxable. If you received crypto as payment, then it should be reported and will come under ordinary income and will be taxable in accordance with its price on the date of the transaction.

If you are buying crypto using other crypto coins or swapping them and using stablecoins to purchase coins then it is a taxable event. If you are selling crypto for any fiat currency, it is taxable and the owner has to pay the capital gain tax as well.

The event of a soft fork is tax-free. Coins received through hard fork do not come under ordinary income but if received through airdrops are taxable. Bitcoin charity may make you eligible for reduced tax liability. However, only crypto donations are considered, not the money you will donate after selling your coins.

Final Thoughts

The digital economy space is still breathing hard and although IRS has done lots of work in making the laws as simple and transparent as possible, crypto traders may still have several doubts. It is best advised to consult a professional tax consultant before filling out the form to prevent any potential charges or fines.