- Informa stock has been in a strong uptrend for a long time. It has generated massive returns for investors in the short term.

- The stock has given over 35% returns in the past 1 year and over 18% returns just in 2023.

- The current setup does not look weak but chances for another big breakout look low too.

Informa plc is a British publishing, business intelligence, and exhibitions group based in London, England. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. It has offices in 43 countries and around 11,000 employees.

The company appears to be highly strong in terms of financials. Its net revenue has been constant throughout the past few years. Net income saw a huge drop in the past couple of years, but a sharp recovery has been seen in 2023. That is a great positive for the stock and its investors.

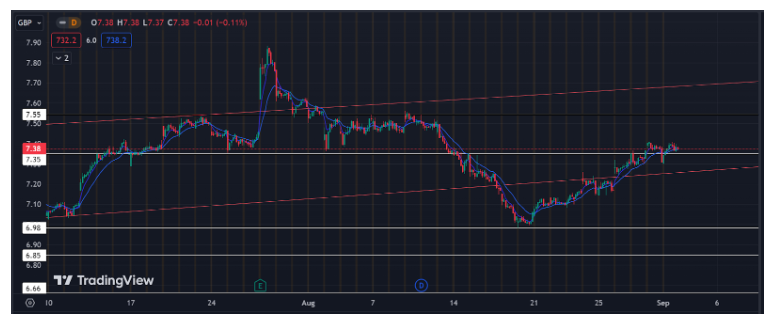

Technical analysis for the stock:

As we see in the chart above, the stock has been in a strong bullish channel since mid-March. It has constantly traded in that. The last few weeks saw a breakdown from this setup. However, it was rejected with strong buying from 6.98£ levels, which has acted as a strong demand zone previously too.

The stock currently trades near the next strong level of £7.35. If the stock sustains these levels, the chances of any negative movement will be reduced.

The stock has previously seen a rejection from £7.35 levels. If that happens this time too, we can expect a downside movement till around £7 zones. £6.85 is our next strong support post this level. However, this can only happen if we see a strong breakdown from the current channel which was previously rejected once.

The stock is very near to its high levels. Thus, a buying entry right now might not make sense. The stock has seen a huge upside this year and the current setup looks like buyers are booking their profits. One must wait for the stock to cool down. A sideways movement always occurs after a stock delivers big moves on either side.

On an hourly chart, we see the stock in the midst of a zone. Therefore, a good entry is possible. Traders can be active because a short entry might occur if the stock gives a healthy breakdown.

The current volumes look neutral as neither the buying nor the selling side is dominating as of now. A sideways movement is expected in the upcoming weeks for the stock.

If the stock gives a healthy and strong breakout of the current channel, one can look forward to buying. Ensure the stock breaks the current high of £7.90! £8.10 and £8.20 are the next targets for the stock based on 2018 levels. One must wait and do a proper analysis before making an entry.

Conclusion:

The current setup for the stock looks neutral as the stock gave a huge upside post. Both buyers and sellers do not look very aggressive as of now. Therefore, a sideways movement is possible. The INF stock trades in a channel and a breakout or breakdown should be watched for.

Important technical levels:

Major support levels: 7.35£ followed by 6.98£.

Major resistance levels: 7.55£ followed by 7.90£.